Rents in Barcelona are Decided in Frankfurt

And it is possible that in the rest of Europe's cities as well.

[Written in August 2020]

Recently, there has been a discussion in Barcelona about whether or not to regulate rental prices. Accessing housing is becoming increasingly difficult as prices are increasing faster than salaries.

As with all topics, there are at least two opposing positions on whether or not to apply regulation. Some say that applying price restrictions will limit the supply of rental properties, create a black market, and encourage payments for other concepts when selecting among interested parties or when prices need to be adjusted annually.

On the other hand, those who defend firm regulation argue that property owners are, in most cases, people who live off rentals and increase their assets through the inexorable housing needs of others.

I am writing this article because, upon examining the evolution of various market variables, I have the impression that price variations may be influenced by factors beyond the rapacious profit motive of owners (which I do not rule out), and may transcend macroeconomic and monetary levels. Unfortunately, these conditions cannot be combated under the current situation.

Let us perform an exercise for someone who has been living in Barcelona for ten years and try to answer questions such as: how much of their income has been dedicated to renting an apartment? How much has their salary varied in these years? This will help us understand the magnitude of the variation, if any.

The data we have comes from the city council, and it represents the prices per square meter extracted from contracts signed between the first quarter of 2014 (1Q-2014) and the third quarter of 2020 (3Q-2020).

For the sake of this article, we will not go into detail about specific zones, why some have experienced greater variation than others, or the magnitude of the prices.

The accumulated change for the ten districts between the 1st quarter of 2014 and the 3rd quarter of 2020 is 3.55 euros per square meter, equivalent to 36.49%, far exceeding the increase in average salary between 2013 and 2019, which according to estimates, was 5.80%.

The questions that arise are: how can housing prices increase faster than people's ability to pay for them, and what factors generate these changes? Let's try to answer them.

We can be certain that the demand for flats has remained despite the increase, as the data we are analyzing is based on signed contracts, indicating that an agreement for property use has already been reached.

As for the causes behind this increase, it is generally associated with:

Limited stock of properties: Barcelona has two natural geographical barriers, surrounded by the sea and Collserola, so there is little surface area to develop new housing.

Increase the number of flats dedicated to short stays, mostly for vacations, such as Airbnb.

Accumulation of properties by a few owners, who artificially increase prices.

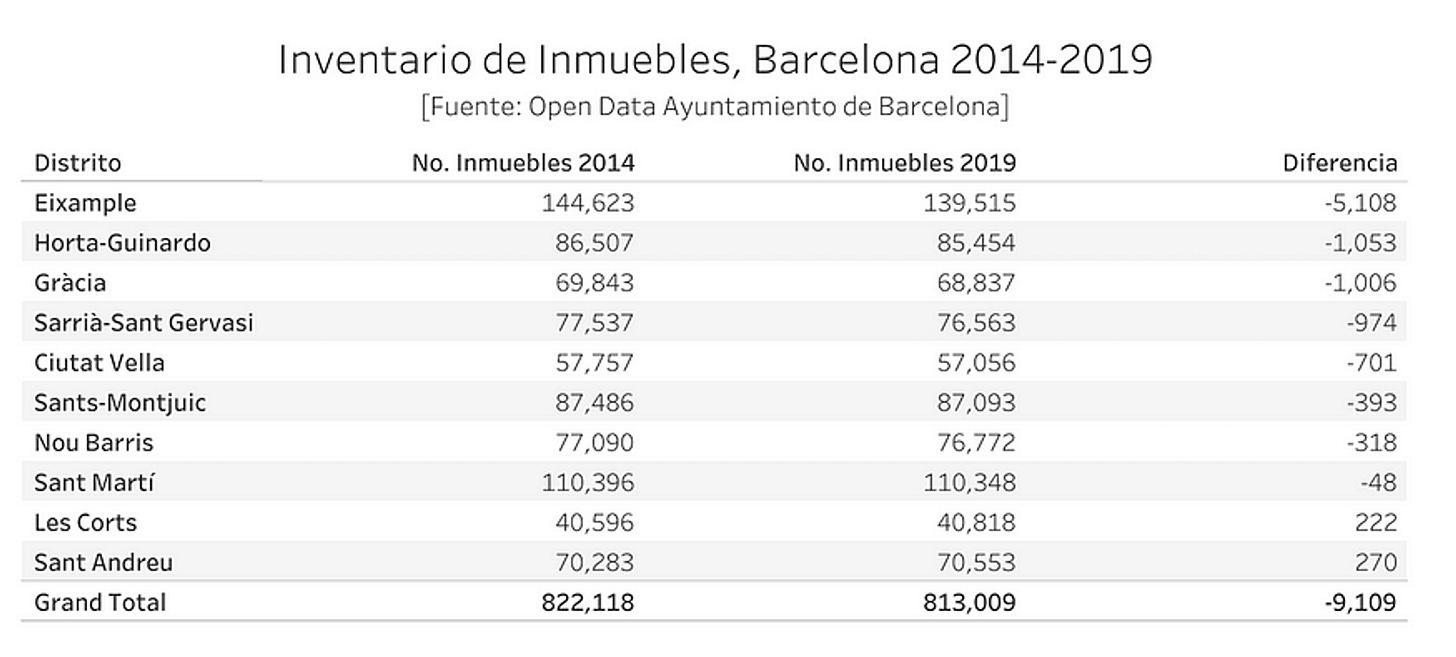

Regarding the first factor, Barcelona has reduced its housing stock by just over nine thousand properties, which is a decrease of 1.11%. However, this seems not to be the cause of the more than proportional jump in price per square meter. Therefore, it is discarded.

Another common factor is the proliferation of tourist rental properties, which are diverted from the long-term rental market to the short-stay and high-rotation market.

Statistics on this sector are unclear, as there seems to be no census that accurately reflects reality. If we visit airbnb.com and search for a stay in Barcelona, the website indicates that there are more than 300 properties to choose from, but it's impossible to see the total number.

If we turn to official sources, according to the latest census conducted by the city council, the total number of properly registered properties reaches 696.

If we stick to this number, without investigating its veracity, its relative weight compared to the total number of housing units in Barcelona (of any type and size) represents 0.09% of the residential real estate market.

The third point, that of large property holders, was reported by La Vanguardia on July 29, 2020:

According to the report, based on data from the municipal register of Barcelona and the deposits made in the Catalan Land Institute, there are 212,901 rental properties in the Catalan capital owned by 100,200 landlords, averaging 2.1 rental properties per owner. However, 69,037 (32.4%) of these properties are concentrated in 2,344 (2.3%) landlords who own more than 10.

The Metropolitan Observatory of Housing in Barcelona (O-HB) prepared the report.

From this reality, we could assume that the decisions of a few people affect the entire market. If there were collusion to fix prices, this would be easily executable due to the 'power' that a small group holds over almost a third of the rental housing market.

A generalized and coordinated increase in prices would be taken advantage of by small property holders seeking to maximize their income, a phenomenon that is repeated in any supply and demand market.

However, there are no indicators that describe the temporal change in the rental prices of properties offered by large property holders, and the market is analyzed as a whole, leaving all the explanations of the variations in a single factor is less responsible from an analytical point of view.

This is when a fourth variable comes into play. How plausible is it to think that monetary policy affects price fixing?

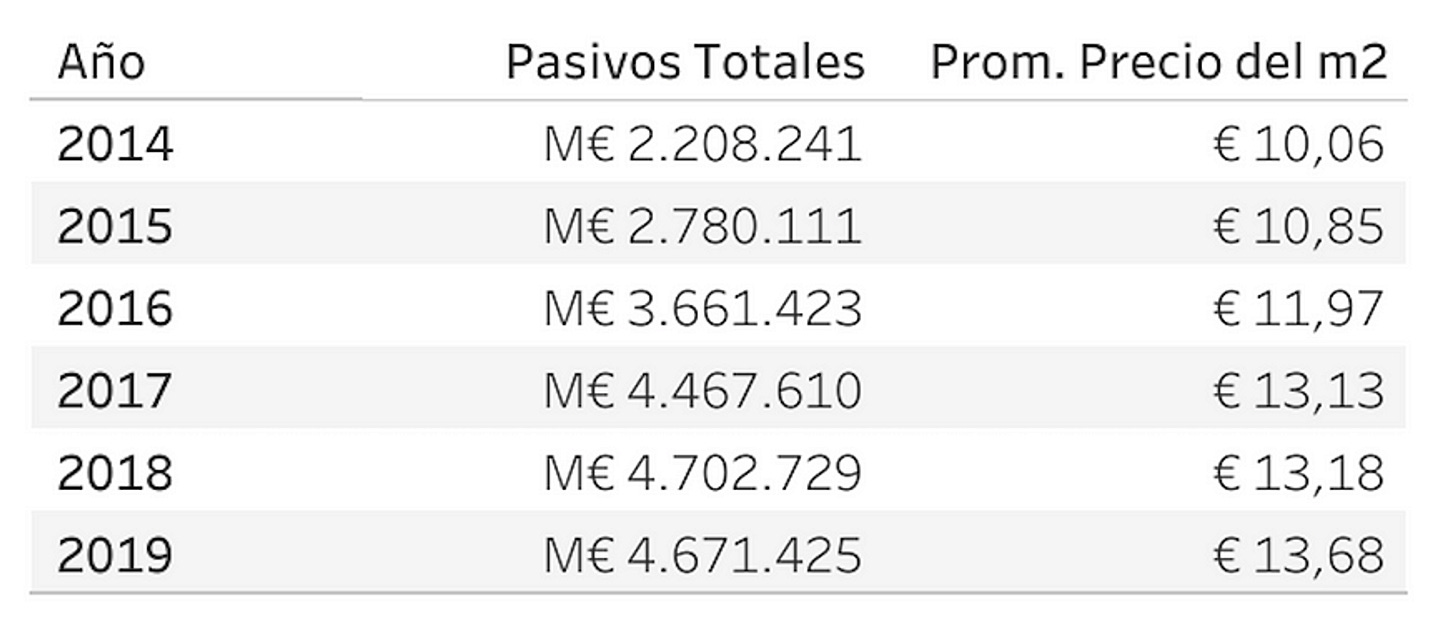

Since 2008, regarding the great financial crisis caused by the fall of Lehman Brothers, the Federal Reserve, the European Central Bank, and the Bank of Japan have expanded the available monetary mass, not only in the form of circulating money but also in purchases of bonds and stocks. This graph shows the change in the ECB's balance sheet on the asset side, which presents in purple what are called 'securities'’ financial instruments for raising capital. By increasing its level, the bank bought debt commitments from third parties in exchange for cash.

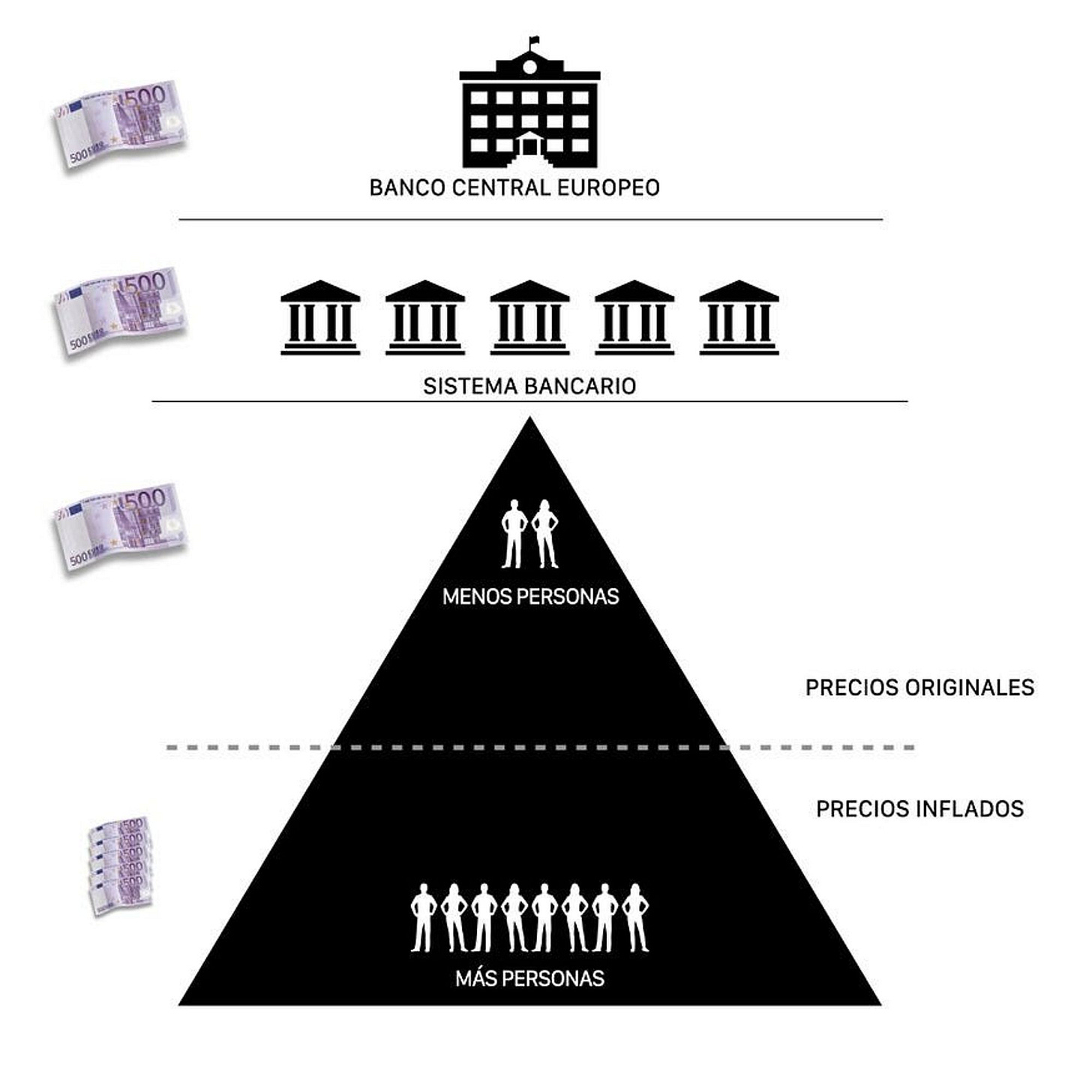

This money created by the bank enters the financial stream through banks to boost aggregate demand in search of a response from supply, which ultimately translates into more employment and consumption. So far, everyone is happy and in agreement.

The problem arises when these funds produce the so-called "Cantillon effect"” through which those who receive the funds are better positioned, giving them an advantage over other companies and individuals. This advantage translates into the ability to acquire goods at a lower price before the system absorbs the effect of the increase in the monetary mass.

This reinforces a cycle of accumulation in which property purchase is one of its expressions. The intrinsic nature of these, the inexorable need to have a roof, and the limited and even decreasing supply have caused the price per square meter of rent to increase more than the price of gold in the period 2014-2019.

Regulation, therefore, is ineffective and useless. In this respect, I do not advocate for full freedom in the property system, as the rental market and housing in general have implications much deeper than, for example, taxes or even the labor market. The ideal scenario would be a free fluctuation of supply and demand - if there was no effect that expansionary monetary policy has.

Statistically, the evidence is clear. The increase in rental prices corresponds almost perfectly with the increase in the Euro money supply, which we determine through a simple correlation.

Simply put, if there is no relationship between the variables, the result will tend towards 0 (zero), and if there is one, the result will be closer to 1.

By performing this operation, the result of 0.96 indicates that the growth of the two variables follows the same pattern.

Note: The correlation was made by taking the 2013 data for ECB liabilities and the 2014 data for rents, assuming a lag in the effect of the increase in the money supply.

In November 2020, the European Central Bank announced that "it is preparing to expand in December the emergency program to purchase public and private debt due to the pandemic (endowed so far with 1.35 trillion euros until the end of June 2021) and the injections of cheap liquidity to banks to grant loans."

Predictably, these funds will further inflate the prices of rents and properties themselves for two main reasons:

Liquidity tends to end up in the same hands: those with the capital to acquire more assets and/or incur debt.

The excess liquidity will keep interest rates very low, increasing the risk.

Therefore, the issue of rental prices is a two-sided coin. Europe is an important economy and the world's largest market. Its measures to incentivize spending and reactivate the economic cycle are the same ones that generate unwanted side effects.

It is unlikely that the expected growth can be achieved through a non-expansive policy, which is why in Barcelona, two phenomena will coexist: first, more than a third of the housing stock in the hands of a few; second, a regulation that will incentivize agreements and payments outside the law.

Juan Carlos Golindano S