5 unsolicited opinions [No.1].

"If the shoeshine boys are giving stock tips, it's time to get out of the market."-Joseph Kennedy

I. Don't Invest in Real Estate for Now

I understand you may feel like you missed out on a great opportunity by not taking advantage of the low-interest rates and buying a property to showcase on your Instagram. However, despite the number of signed mortgages suggesting that the subprime crisis never happened, it's important to remember that this was a temporary mistake that was only corrected due to the successful actions of the United States monetary authorities and the European Central Bank. For now, it is not recommended to invest in real estate.

You may have heard that a few years ago, large amounts of money were printed to boost the economy during turbulent times. But do you know to what extent? The following chart will give you an idea:

In 2009, approximately 2.5 trillion dollars were allocated to stimulate the economy. During the COVID pandemic, the amount allocated for the same purpose was 12 trillion, almost five times more. This trend, which began in 2010, was intensified with the arrival of the pandemic and lasted just over ten years.

However, this new liquidity has generated several economic distortions, such as inflation, increased inequality, startup mania, influencers, and increased real estate prices.

But how can you tell if it's a bad time to buy a property? An indicator, the National Home Price Index, should be considered when evaluating the possibility of buying property in both the United States and Europe. It is important to note that people tend to buy property even in bullish periods, ignoring this important indicator.

In the United States, the most recent graph (as of July 2022) is as follows:

The red bars on the graph show the difference between the maximum price reached during the peak of sub-prime mortgages (mortgages acquired by people without employment or income in many cases) and the current price.

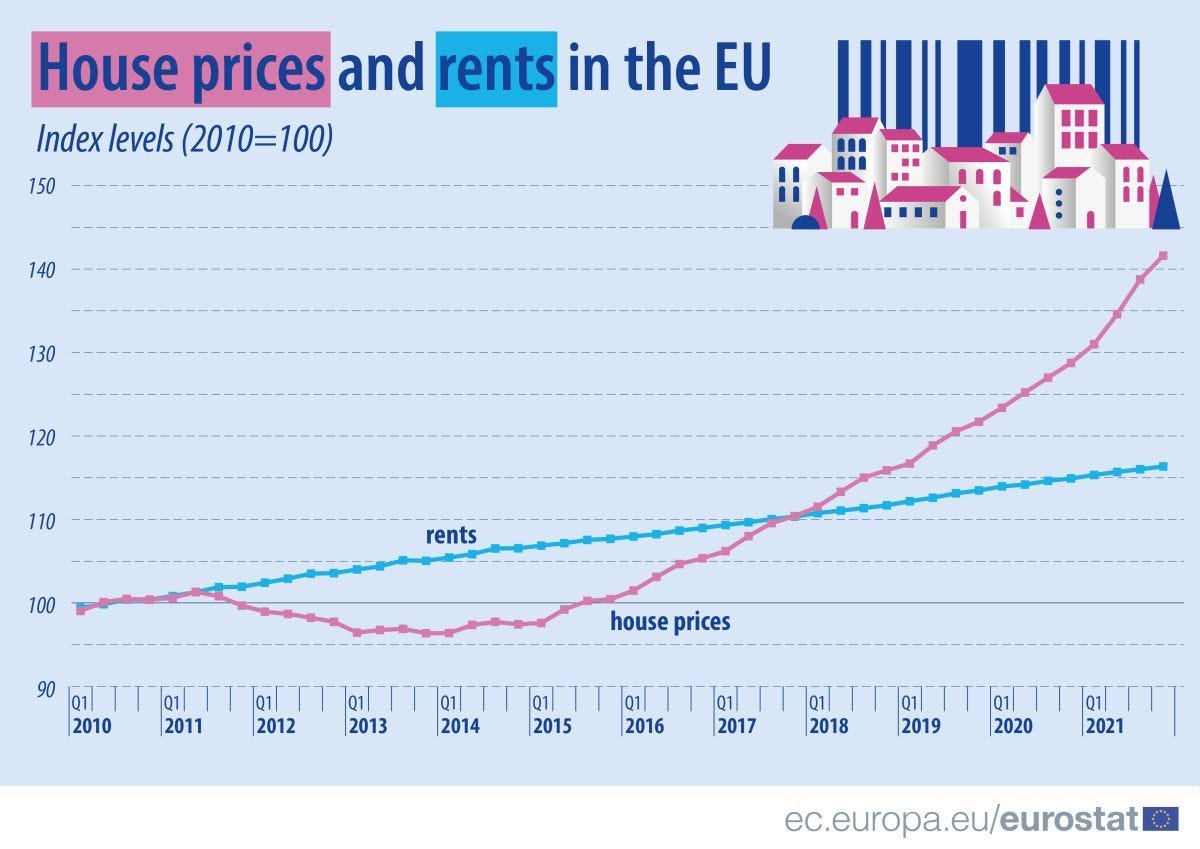

In Europe, the graph follows a similar trajectory, indicating an upward trend and reaching maximum values.

These two charts indicate that housing prices are likely at their peak and may fall with even a slight change in monetary policy. This could be due to a slowdown in demand or an increase in interest rates caused by inflationary pressures in most countries.

It's possible to prevent a collapse of the housing market through a "soft landing" strategy, which involves gradually raising interest rates to slow down the rise in prices. However, it requires exceptional skill to execute successfully.

If this strategy works, prices will continue to rise without any price correction or changes in consumer spending habits. However, this scenario is unlikely, if not utopian. It may be advisable to wait for a while and see what happens.

II. Gasoline Prices Will Decrease

The maxim "what goes up must come down" also applies to fuel prices. After a significant increase, prices tend to decrease due to the "destruction of demand" phenomenon. As prices rise, customers purchase less fuel because they have limited budgets.

In the past, rapid increases in gasoline prices led to global economic crises, such as the "Great Financial Crisis" of 2008 and the sovereign debt crisis in Europe in 2012.

There are opinions that suggest sub-prime mortgages, in particular, led to insolvency due to the essential need to fill up gas tanks. This was especially true in the United States, where suburban life necessitates vehicle use.

III. El Dato

According to the recently published BP Energy Outlook, the world consumed the equivalent of 272.45 exajoules in 2020, of which 82% came from fossil fuels: oil, gas, and coal. In 2020, during the pandemic, the percentage was 78%, which may be considered anomalous.

Despite summits such as Glasgow that seek to limit the use of fossil fuels and reduce greenhouse gases, the reality is that the vast majority of agricultural, industrial, and service activity depends heavily on these types of fuels. Alternative sources such as wind or solar power are not economically or physically viable for maintaining the current price structure, production levels, or infrastructure.

Furthermore, environmental commitments are voluntary, and no country is legally obligated to fulfill them. Restricting access to fossil fuels or artificially increasing prices would affect GDP data more than proportionally in countries where fossil energy is the basis for productive activity. For example, India, Thailand, Egypt, South Africa, Kazakhstan, Belarus, Uzbekistan, Iran, Iraq, Indonesia, Malaysia, and Bangladesh depend on a combination of oil, gas, and coal by more than 90%, and their combined population exceeds 2 billion inhabitants.

In other news, Mark Zuckerberg, the creator of the first network that truly interconnected billions of people, criticized the Biden government regarding the state of the economy. He stated, "If I had to bet, I would say this could be one of the worst downturns we've seen in recent history." This statement is noteworthy as it directly criticizes a government that the vast majority of executives in the technology industry unreservedly support. These are the words of someone who does not want to be dragged down by the decisions of the politician in charge, especially since his company has lost more than 50% of its market value in the last year.

The second, and perhaps most important reason behind the scenes, is that as the economy overheats in response to the Federal Reserve's monetary expansion, the cost of retaining and attracting talent grows at a pace equal to or greater than inflation. If expected benefits fall due to a reduction in advertiser spending - economic agents who already perceive the cycle change as a whole - and payroll spending rises, adjustments will have to be made somewhere.

Zuckerberg's statement, then, is more than an exercise in the economic foresight of a media executive. It is a chronicle of what will happen in the coming months: large-scale layoffs.

V. Crypto-suffering

A few days ago, while trying to watch a YouTube video, I realized that the demonized algorithm had recognized that one afternoon I had been interested in the value of Bitcoin. The very intelligent system understood that I might be interested in having a young man in his mid-20s tell me how to invest in cryptos and live like him, beside a pool in a sunny country with non-existent taxes.

I thought it was an act of bravery, given that at 45 years old, with 20 years of being an economist under my belt, I wouldn't dare tell someone what to do to secure their future.

The reason for this phenomenon of crypto-influencers is the absolute irresponsibility of the monetary authorities of the world's major economies. Keeping interest rates artificially low, promoting a culture of excessive spending and risk, led to a bubble that had little basis in reality.

I am not against cryptocurrencies. I have bought and sold Bitcoin, I understand the reasons behind their ethos and their usefulness in the face of Big Brother's watchful eye. They more than satisfy some of the reasons for something to be considered money, as they can be used as a store of value, are not subject to devaluation, can serve as a unit of measure, and can be exchanged (albeit with difficulty).

Bitcoin, as the leader of the ecosystem, behaves like any other asset, serving as a hedge as long as market conditions are stable and expansive. When the wind blows against it, it is very difficult for it to compete against other assets, whether they be real estate or financial (bonds, stocks), due to its high volatility.

Initially, being outside the tax system allowed holders of these coins to store value without being subject to any taxes. As time passes, this gray area limits the entry and exit of capital, a versatility necessary in times of crisis.

Another factor is war. Cryptocurrencies were created in an abnormally long period of peace, a period of appeasement after the fall of the Berlin Wall and the establishment of Western liberal capitalism as the only known alternative for achieving development. Although during this time, Al-Qaeda and ISIS gained fame for their butchery practices, the violence was not between articulated states, so they were no more than isolated hotspots.

What does the Tarot say?

Nassim Nicholas Taleb, author of the magnificent book Antifragile, argues that the intrinsic value of Bitcoin is zero, as it cannot generate income. Bitcoin is not the translation of a set of productive activities - a country's economy - into a medium of exchange - the country's currency-. Its price will depend on purchases made using legal tender, and due to supply and demand factors, its price will fluctuate.

Despite cryptocurrencies being a concrete concept - a digital currency that uses blockchain technology - its validity, usefulness, suitability, and convenience will depend on the ideology of the person analyzing it. In the end, although economics is a science that tries to present numerical equilibria based on mathematical models that assume that each person will choose what maximizes their well-being, subjectivity is responsible for almost all our decisions.

Mi impresión es que las criptomonedas son un activo no-prioritario, a nivel de los familias e individuos, son adquiridas una vez otras áreas del día a día están cubiertas: vivienda, energía, comida. En el caso macro, donde juegan los grandes capitales, los beneficios se obtienen a partir de un mercado al alza, con tasas de interés bajas que permitan el apalancamiento y cuya volatilidad sea menor que otros activos disponibles (acciones de empresas prioritarias).